Overcoming the electronic payment plateau

Pillars of success for driving electronic payment adoption to 100%

The Challenge

Experts exclaim that the paper check is dead. The 2013 Federal Reserve Payment Study found that the number of paper checks paid fell at a rate of 9.2% CAGR from 2009-2012 and checks will continue to decline in favor of ACH, credit and debit cards. Yet – despite investing in an electronic payment portal – Property Management firms still spend an inordinate amount of resources processing paper checks because their electronic adoption rate has plateaued.

Committing to the goal of increasing electronic payment adoption is imperative. Electronic payments not only have benefits of convenience, safety, and cost per deposit, but electronic payments enable a Property Management firm to realize operational efficiencies. The challenge is not in convincing leadership of the necessity for an electronic payment portal, but the challenge lies in creating a business priority and identifying the most effective tactics to meaningfully impact the electronic adoption rate.

Case Study

A top 15 New York Property Management firm was frustrated with its costs associated with rent collection. The firm maintained a lackluster internal ACH program, but believed it was still expending excessive time and resources processing checks. In response, the AR Executive engaged ClickPay to create a custom strategy for disrupting the patterns of their tenants’ payment behaviors. ClickPay assessed the AR Executive’s operating procedures, which were not dissimilar from ClickPay’s average client, and developed a toolkit of tactics based on the firm’s population. ClickPay rallied the Leadership Team around the idea of transforming its processes and procedures and began driving electronic payments. The first initiative was to replace the firm’s internal electronic payment system with ClickPay’s best-in-class electronic payment platform. Tenants are more likely to pay electronically if the system is simple, secure, and serviced. ClickPay’s one-click activation streamlines the registration and payment experience, and the site is mobile responsive for payments on the go. In comparison, the firm’s internal portal was cumbersome and insecure. Tenants responded to the upgrade in payment portal and the number of electronic payments jumped immediately.

The next large tactic the Property Management firm undertook to induce electronic payments was to end paper billing. Instead of paying a printing service and the post office to send monthly bills, ClickPay began emailing tenants with electronic bills that directly connected into the tenants’ own online payment pages. By providing tenants with a coupon and envelope, the firm neglected to realize that it was incenting paper check payments. The Property Management firm’s move to electronic bills also saved them hundreds of thousands of dollars in bill printing and postage annually.

Lastly, ClickPay worked with the firm to market the payment preference to tenants. ClickPay’s marketing team designed bespoke materials to communicate the changes and promote electronic payments. Door tags, email blasts, flyers for placement in common areas, and Board Member letters are some of the marketing assets that again elevated the firm’s percentage of electronic payments. The Property Management firm now maintains over a 90% electronic payment rate, which cut costs, increased efficiencies, and improved employee and tenant satisfaction.

The Solution

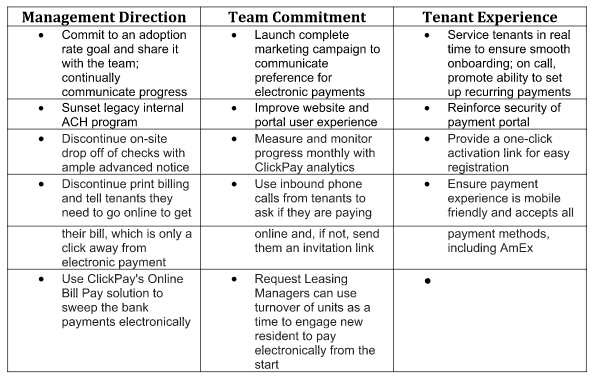

The solution is as simple as commitment and the right tactics. A Property Management firm knows its own tenant population and can develop a robust strategy to drive electronic payments that will resonate accordingly. Tactics to drive tenant adoption range in depth and breadth. Property Managers can choose to sunset paper-based bills and lockboxes, enforce electronic payment channels, and launch marketing campaigns. Additionally, involving the entire firm in the initiative is a best practice. Incentivizing staff with contests and ending a tenant’s service call with a reminder to pay electronically are also effective methods for creating an integrated experience for the firm and its tenants.

A selection of ClickPay’s time tested electronic payment drivers:

Regardless of chosen tactics, investing in accelerating electronic payment adoption is a worthwhile business goal. If interested in discussing best practices tailored to your firm, ClickPay is available to share its expertise.

Source

https://www.frbservices.org/files/communications/pdf/general/121614_2013_fed_res_paymt_study_combined_exhibits.pdf